In order to generate social value, we try to reach the largest number of people with our products and services in the shortest time possible. Thus, in 2011, we were able to expand to Peru and Guatemala and create Yastás, our correspondent bank management company. In 2012, our expansion was horizontal as we diversified our products and services to leverage new market requirements, which led to the creation of Aterna, our micro insurance broker in a partnership with Grupo CP.

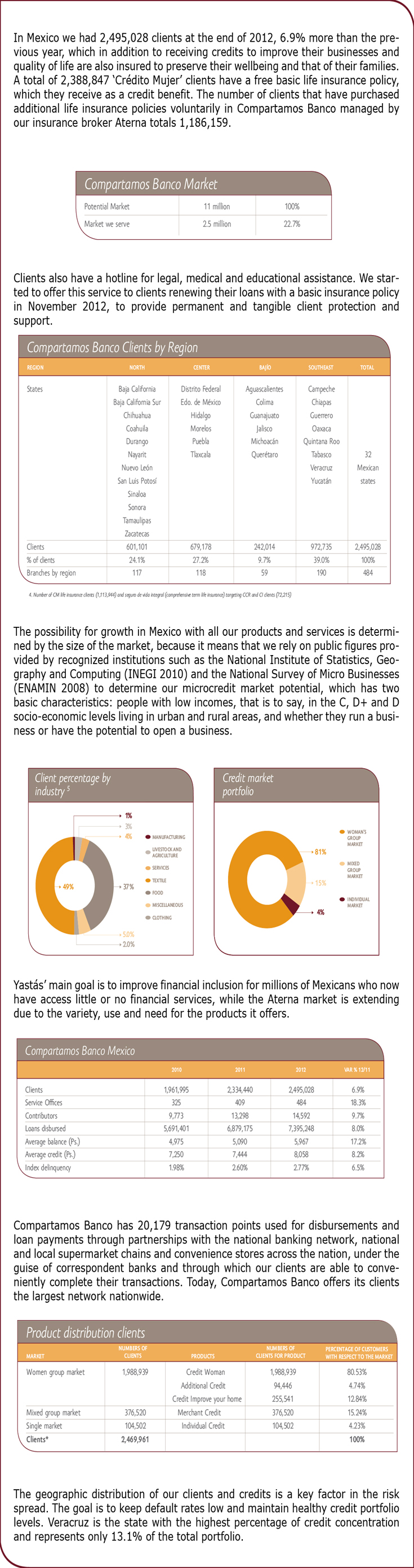

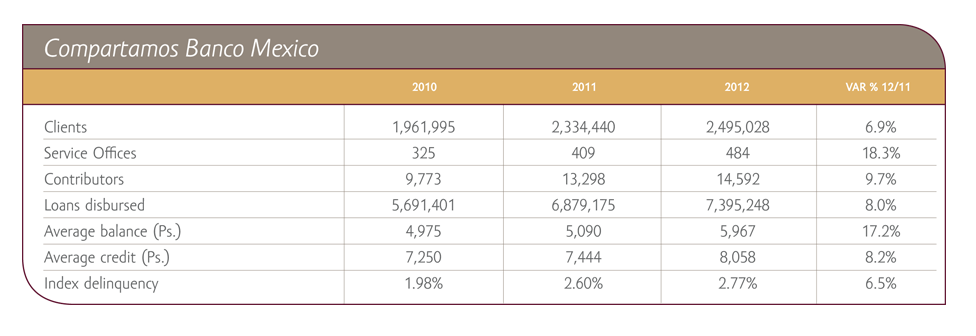

In Mexico we had 2,495,028 clients at the end of 2012, 6.9% more than the previous year, which in addition to receiving credits to improve their businesses and quality of life are also insured to preserve their wellbeing and that of their families. A total of 2,388,847 ‘Crédito Mujer’ clients have a free basic life insurance policy, which they receive as a credit benefit. The number of clients that have purchased additional life insurance policies voluntarily in Compartamos Banco managed by our insurance broker Aterna totals 1,186,159.

Clients also have a hotline for legal, medical and educational assistance. We started to offer this service to clients renewing their loans with a basic insurance policy in November 2012, to provide permanent and tangible client protection and support.

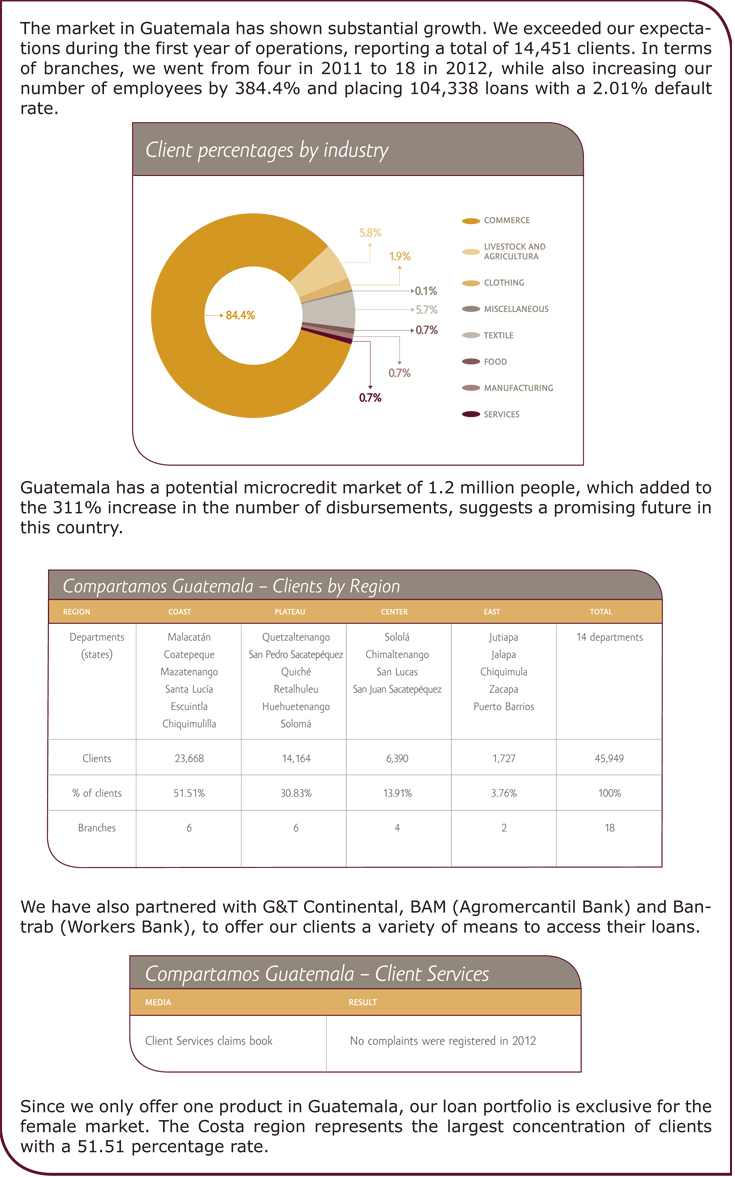

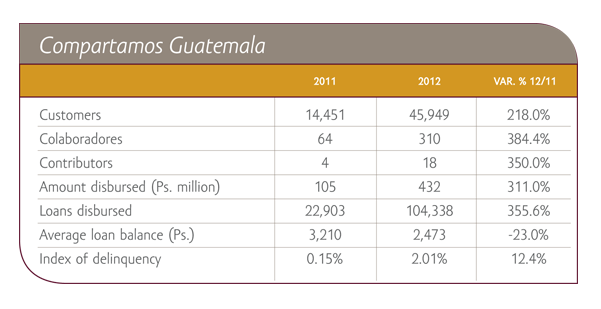

The market in Guatemala has shown substantial growth. We exceeded our expectations during the first year of operations, reporting a total of 14,451 clients. In terms of branches, we went from four in 2011 to 18 in 2012, while also increasing our number of employees by 384.4% and placing 104,338 loans with a 2.01% default rate.

We implemented ‘SIGUE’, our strategic compliance tool with indicators to integrate the Group’s overall strategy while also focusing on training processes and positioning of the Grupo Compartamos principles.