The potential market for microcredits in Mexico, Guatemala and Peru is estimated at 19.7 million. During 2012, we reinforced our structure and processes to consolidate the growth of 16,413 employees focused on microcredits and 2,495,028 clients. In Guatemala we increased the number of clients by 218%, and the number of employees by 384%. In Peru we launched ‘Crédito Súper Mujer’ which closed the year with 4,946 female clients.

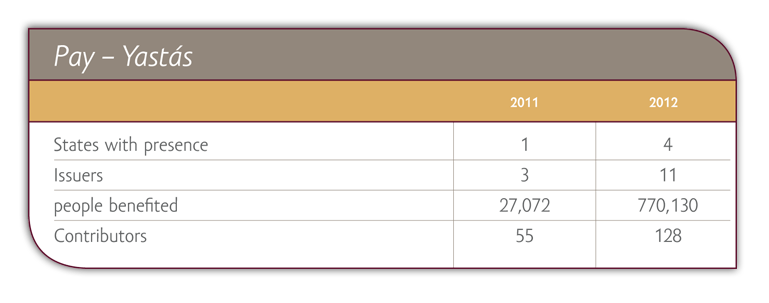

In 2012, Yastás positioned itself as a highly relevant network in communities which lacked infrastructure for payment of services and prepaid phone airtime reloads. This innovative network of establishments has enabled residents of such entities to save time and money in terms of the distance they had to travel to complete their transactions.

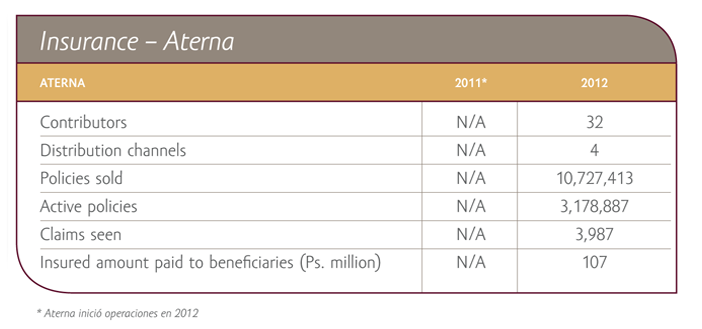

Aterna is a leading micro insurance broker in Mexico. We seek to eradicate financial exclusion by promoting a culture of prevention at the Base of the Pyramid. We design and operate products and services tailored to meet our clients’ needs, and distribute them through a variety of channels.

In Mexico we closed 2012 with 3,178,887 active policies. We delivered more than Ps. 107 million in claims paid to clients and their families, and serviced 3,987 insurance claims. Our maximum response time in paying a beneficiary is 48 hours.

We keep moving forward with our canvassing projects intended to meet a number of Grupo Compartamos objectives, such as retaining and expanding our client base. That is to say, diversify in order to serve new markets, work in a collective effort with Yastás to open savings accounts designed to meet the needs of industry, including security and availability. We also seek to strengthen our funding capability and contribute to our goal of eradicating financial exclusion.

At December 2012, a total of 63,038 people had saving accounts (Compartamos Personal Account) in the cities of Coatzacoalcos and Minatitlán in the state of Veracruz; that is to say, over 90% of the client base in the region. We operate two ATMs and own five bank branches to offer our clients full transactional services with the quality and warmth they have come to expect from us.

We train our employees and clients in financial education programs and support the community in general to provide them with tools to aid them in decision-making processes that promote financial health and generate personal and family wellness. During 2012, a total of 307,582 community members, employees and clients participated in financial education activities representing 318,967 man hours.