At Gentera we believe that transparency and adherence to the best corporate governance practices are essential for the Group and its companies’ success as well as being fundamental to ensure their development and long-term sustainability. Therefore, commitment to our beliefs and institutional values are reflected in our government model, which is renowned for its adherence to all legal regulations in the countries where we operate and to standards and best practices established by business groups as the Code of Best Corporate Practices from the Business Coordinating Council of Mexico.

Gentera’s governance model has been recognized by multilateral agencies and international companies, being invited to join the Companies Circle, which it belongs since 2011, created by the International Finance Corporation (IFC) and the Organization for Economic Cooperation and Development (OECD), with funding and support from the Global Corporate Governance Forum, joining leading companies in Latin American by the adoption of best corporate governance practices and a strong presence and impeccable reputation in their capital markets. During 2014, the Deputy Secretary of the Board of Gentera was appointed as Vice-president of the Companies Circle.

Furthermore, during this year improvements were implemented to the governance model to align it to the Group’s operational services strategy, seeking to optimize our value chain and considering the evolution and scope achieved by Gentera and its companies, financial products, needs and international interests, promoting financial transparency, responsibility and high ethical standards for sustainability and results for our shareholders, clients, employees and other stakeholders.

As a result, the number of committees that support the Board of Directors increased, thus strengthening the monitoring and implementation of agreements and decision making by the governing bodies of all organizational units.

The creation of the Committee of Information Systems and Technology and the Committee of External Relations and Social Responsibility, are part of such improvements to provide more attention to issues of high relevance, such as establishing contingency plans, information management and control and strengthening the principles of social responsibility and sustainability.

Board of Directors

G4-LA12

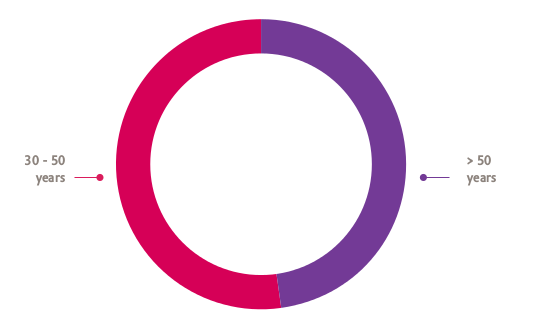

Our Board of Directors is comprised by 13 members, seven of whom are independent (54%), while two of these are women (15.4% of total). The distribution by age of the Board members is:

Our Board of Directors’ features during 2014 were:

- The Group was led by strong corporate governance that supports international expansion

- Board of Directors comprised by specialists in several fields and branches that enrich the Group's long-term strategic vision

- 63% of the committees were chaired by independent directors

- According to the research conducted by the Corporate Practices Committee and external consultants, remuneration of board members was in line with market standards

- Officials who were part of the Board did not receive remuneration for this work

-

Gentera and each of its companies have a Board of Directors that allows the optimal achievement of its strategy and business sustainabilityG4-44A comprehensive annual performance evaluation of the Board’s operation and the quality of its annual activity was implemented, entailing:

- The self-assessment of each principal director

- The assessment made by each member to the Board as a collegiate body

- The assessment for each committee, made by its members

- The assessment by the management team to the Board

-

G4-41Gentera and its companies have a policy that rules and regulates related party transactions, which states that governing bodies review and approve such operations to avoid conflicts of interest. Besides, they observe the guidelines contained in our Code of Ethics and Conduct

DMA SP 36 - Promotion of constant training to members of the Board of Directors, the Legal Direction and the team in charge of Gentera’s corporate governance, through their participation in training courses for updating and improving a good corporate governance, such as "Directors' College" by the Rock Center for Corporate Governance at Stanford University; "Relevant Legal Aspects" by the Autonomous Technological Institute of Mexico (ITAM); and Foundations’ Management, by the National Autonomous University of Mexico

- Gentera participated as one of the exhibitors at forums like "Experiences of Good Corporate Governance in Latin America" testifying on sustainability in San Jose, Costa Rica and "Corporate Governance of Company Groups: International and Latin American Experience" on Business Groups in Bogota, Colombia

of our independent Principal Directors are women

The Boards of Directors of each of our companies are integrated by related and independent advisors, human capital highly qualified, outstanding and experienced in various fields of professional knowledge: banking, economics, finance, administration, logistics, marketing, systems, accounting, social responsibility and sustainability, among other areas. Having this strong team allows us to enjoy significant gains in growth, profitability and sustainability.

| Principal Directors | Status | Seniority in the Board |

|---|---|---|

| Álvaro Rodríguez Arregui | Independent | 11 years |

| Carlos Antonio Danel Cendoya | Related | 14 years |

| Carlos Labarthe Costas | Related | 14 years |

| Claudio Xavier González Guajardo | Independent | 3 years |

| Guillermo José Simán Dada | Independent | 5 years |

| John Anthony Santa María Otazúa | Independent | 6 years |

| José Ignacio Ávalos Hernández | Related | 14 years |

| José Manuel Canal Hernando | Independent | 11 years |

| Juan Ignacio Casanueva Pérez | Related | 4 years |

| Juan José Gutiérrez Chapa | Related | 13 years |

| Luis Fernando Narchi Karam | Related | 13 years |

| Martha Elena González Caballero | Independent | 8 years |

| Rose Nicole Dominique Reich Sapire | Independent | 1 year |

| President |

|---|

| Carlos Antonio Danel Cendoya |

| Secretary |

| Manuel de la Fuente Morales |

| Alternate Secretary |

| Mariel Eloina Cabanas Suárez |

is supported by eight committees

Board of Directors’ Committees

Audit Committee

The Audit Committee assists the Board in its auditing function, ensuring that both internal and external audits are performed with the greatest possible objectivity and independence and that the financial information presented to the Board, shareholders, and the general public is responsible, transparent, sufficient, timely, and an accurate reflection of the financial situation of Gentera and its companies. The Audit Committee is also responsible for permanently validating the internal control and issuing process of financial information, all within the framework of the company bylaws, legal requirements, all other applicable provisions and its own regulations.

Commercial Strategy Committee

To assist the Board in defining and monitoring the medium and long term commercial and operating strategies, based on the deep understanding of the market, competitors, clients’ needs and the applicability of several technologies which, all together, ensure an ideal competitive positioning and return for Gentera and its companies.

Executive Committee

The Executive Committee acts as an auxiliary body whose objective is to monitor the Group’s strategy, support Management in the analysis and discussion of strategic or significant issues, as well as to serve as the liaison between the Board and Management ensuring a more fluid communication.

Finance and Planning Committee

To support the Board in defining a long term strategic vision and identification, control and financial risks disclosure mechanisms, in addition to validating the policies and guidelines proposed by Management regarding strategic planning, investments, financing, and annual budget and its control system.

Corporate Practices Committee

To oversee the management, conduct and execution of Gentera and its companies’ businesses, within the framework of their respective responsibilities and in accordance with company bylaws and legal requirements.

Risk Committee

The Risk Committee is a Board’s assistance body, whose purpose is to review and manage the risks Gentera and its companies are exposed, along with monitoring the execution of operations is in concordance to objectives, policies and procedures and meets the global risk exposure limits, previously approved by the Board.

Technology Information Systems Committee

This Committees’ objective is to support the Board in the definition and monitoring of medium and long term technologic strategies of Gentera and its companies.

External Relations and Social Responsibility Committee

It assists the Board in the definition of the strategic vision and validating the policies and guidelines regarding public positioning, identity, social responsibility and sustainability of Gentera and its companies, promoting the generation of a favorable environment for the business model’s development through sound and permanent external relations, as well as the promotion of sustainable development and corporate social responsibility.

Directors’ Appointment and Revocation

In order to protect the interests of Gentera and its shareholders, a policy for the evaluation of candidates for directors was approved, entrusting this task to the "Nominating and Evaluation Commission", which has the participation of independent and related directors. This way, the Shareholders’ Meeting has enough information at the moment of appointing new directors and has a plurality of opinions and degree of training, education and proper reputational history to provide value to the organization. It also considers aspects such as turnover rate, term of office, revocation of the order and succession.

Members of the Board of Directors

Members

Álvaro Rodríguez Arregui

Economist, graduated from Instituto Tecnológico Autonomo de México (ITAM) with an MBA from Harvard Business School. Currently he is co-founder and CEO of IGNIA, a social impact fund focused on the bottom of the pyramid. He is Vice President of the Board of Directors of Banco Compartamos, S.A., Multiple Banking Institution ; Councilor at Harvard University David Rockefeller, Center for Latin American Studies; he belongs to the Alumni Council of Harvard Business School, Global Social Progress Imperative; ACCION International; Business Coordinating Council and the National Cancer Institute. He also participates in impact investments initiatives of Duke University CASE, Harvard Business School and the World Economic Forum. He mentors Endeavor. Specialized in business.

Carlos Antonio Danel Cendoya

Architect, graduated from Universidad Iberoamericana. He has a MBA from the Instituto Panamericano de Alta Dirección de Empresa (IPADE) and microfinance studies from The Economist Institute (Boulder), Harvard Bussiness School. Currently he is the Chairman of the Board of Directors of Banco Compartamos, S.A., Institucion de Banca Multiple; Councilor of Aterna, Agente de Seguros y Fianzas, S.A. de C.V.; Controladora AT, S.A.P.I. de C.V., and Fundacion Gentera, A.C.

Carlos Labarthe Costas

Industrial Engineer graduated from Universidad Anáhuac. He studied business and microfinance in The Economist Institute (Boulder) and senior management at the Instituto Panamericano de Alta Dirección de Empresa (IPADE Business School). Currently, he is President and Director of Banco Compartamos, S.A., Multiple Banking Institution; Councilor of Compartamos, S.A. (Guatemala); Compartamos Financiera, S.A.; Red Yastas, S.A. de C.V.; Aterna, Agente de Seguros y Finanzas, S.A. de C.V.; Compartamos Servicios, Inc. de C.V.; Controladora AT, S.A.P.I. de C.V.; Fundacion Gentera, A.C.; Worldfund, Advenio y Vista Desarrollos, IGNIA and he is also Chairman of the Board of Consejo de Administracion de Promocion Escolar, S.C. and Grupo Kipling.

Claudio Xavier González Guajardo

Graduated from the Escuela Libre de Derecho, with a Masters in Law and Diplomacy and a PhD in Law and International Relations, from the Fletcher School of Law and Diplomacy, Tufts University. Currently, he is President and co-founder of Mexicanos Primero, A.C., an organization dedicated to increasing the education’s quantity and quality in Mexico and Visión 2013, A.C. He is co-founder and member of the Technical Committee of BÉCALOS; co-founder and Honorary Chairman of the Board of the Patronato de la Unión de Empresarios para la Tecnología en la Educación, A.C. (UNETE) and co-founder and former President of Fundación Televisa, A.C. He is Director of Banco Compartamos, S.A., Multiple Banking Institution. He specializes in creating mechanisms for citizen participation, philanthropy and improving education’s quality, from civil society.

Guillermo José Simán Dada

Business Administration and Economics from Loyola University - New Orleans. He has an MBA by the Sloan School of Management at Massachusetts Institute of Technology (MIT), specializing in corporate strategy, information systems and international management. He is currently Vice President of the Board and Executive Vice President of Grupo Siman, which operates under its "holdings" ALSICORP and REGAL FOREST; Chairman of the Board and CEO of SERVICORP. His responsibilities also include the Corporate Services division, which provides systems and technology, logistics and distribution, planning and other services to all business units of the same Group, he is Director and Vice President of GS1 in El Salvador, Director of Banco Compartamos S.A. Multiple Banking Institution, Aterna, Agente de Seguros y Fianzas, S.A. de C.V., Controladora AT, S.A.P.I. de C.V. and of El Puerto de Liverpool, S.A.B. de C.V. He specializes in corporate strategies, information systems and international management.

John Anthony Santa María Otazúa

He has a Bachelor Degree in Business Administration and a Masters in Finance from Southern Methodist University Dallas, TX. Currently, he is President of Coca-Cola FEMSA and Director of Banco Compartamos, S.A., Multiple Banking Institution. He specializes in the area of strategic planning.

José Ignacio Ávalos Hernández

He holds a degree in Business Administration from Universidad Anáhuac. He is currently Chairman of Consejo de Promotora Social México, A.C.; Un Kilo de Ayuda, A.C.; COFAS, I.A.P.; COFAT, A.C.; Cooperación y Desarrollo, A.C.; Desarrollo, Ayuda y Alimentos, S.A.; Alimentos en Zonas Rurales, A.C.; Impulsora Social, S.A. He is Director of Banco Compartamos, S.A., Multiple Banking Institution. He specializes in the area of microfinance and philanthropy.

José Manuel Canal Hernando

Public Accountant, graduated from Universidad Nacional Autónoma de México (UNAM). He is currently Principal Director of Banco Compartamos, S.A., Multiple Banking Institution; Director, Curator and Senior Advisor of several companies, both private and registered in securities markets, as FEMSA, Coca-Cola FEMSA, Grupo KUO, Grupo Industrial Saltillo, Fundación Bécalos and Junta de Asistencia Privada del Estado de México. He specializes in auditing, accounting, internal control and corporate governance areas.

Juan Ignacio Casanueva Pérez

Public Accountant, graduated from Universidad Iberoamericana, graduated from "Program of Corporate Governance: Effectiveness and Accountability in the Boardroom", in Kellog Northwest University and of the High Management Program in IPADE Business School. Currently, he is Chairman of Grupo CP, a group comprised by eight companies specializing in different insurance niches; Director and Chairman of Audit Committee at KIO; Director and member of the Audit and Compensation Committees of Grupo AXO; Director of Banco Compartamos, S.A., Multiple Banking Institution; Aterna, Agente de Seguros y Fianzas, S.A. de C.V.; Controladora AT, S.A.P.I. de C.V.; Finances México, S.A.; Hombre Naturaleza A.C.; Endeavor and Consejo de la Comunicación; he is also a member of the Board of Patronato del Fideicomiso Pro-bosque de Chapultepec and president of Fundación Carlos Casanueva Pérez. He specializes in the insurance area.

Juan José Gutiérrez Chapa

Industrial and Systems Engineer, graduated from Instituto Tecnológico de Estudios Superiores de Monterrey. Currently, he participates mainly in the microfinance sector, he is Chairman of the Committee on Financial Inclusion COPARMEX; Chairman of the Board of FOMEPADE, S.A. of C.V.; Director of Banco Compartamos, S.A., Multiple Banking Institution; Financiera Compartamos, S.A. and Compartamos, S.A. He also is an investor and member of boards in various sectors: financial, tourism, restaurateur, real estate and services entities. He specializes in financial, commercial and microfinance areas.

Luis Fernando Narchi Karam

Degree in Business Administration from Universidad Anáhuac. Currently, he is President of Direct Marketing Solutions, S.A. de C.V.; Vice President of Narmex, S.A. de C.V.; Chairman of the Board of Directors of de Promotora de Espectáculos Deportivos de Oaxaca, S.A. de C.V.; Principal Director of Banco Compartamos, S.A., Multiple Banking Institution; Grupo Martí, S.A. de C.V.; Sport City, S.A. de C.V.; Internacional de Cerámica, S.A.B. de C.V. (Interceramic), and other institutions; member of the Advisory Board of Grupo Financiero Banamex, S.A.; member of the Board of the National Cancer Institute and partner of Promotora Campos Elíseos 200.

Martha Elena González Caballero

Certified Public Accountant, graduated from Universidad Iberoamericana, has imparted several courses in the special program Infonavit of IPADE Business School. She is currently Principal Director of Banco Compartamos, S.A., Multiple Banking Institution; Member of the Audit Committee of Infonavit and the Technical Committee of the Mexican Institute of Public Accountants; is Curator of the SD Indeval, the Contraparte Central de Valores and Advisor of the Fondo de defunción del Colegio de Contadores Públicos de México and others. She specializes in the area of audit in the financial sector.

Rose Nicole Dominique Reich Sapire

Degree in Administrative Computer Systems, from Instituto Tecnológico de Estudios Superiores de Monterrey. She has an MBA from the Instituto Tecnológico Autónomo de México, with The Corporate Leader Program from Harvard Business School of Management, Boston, MA, USA. She is currently Principal Director of Industrias Diesco, of WPO Capítulo México; “Por lo derecho”; Construsistem, S.A de C.V. Until 2012, she was the Executive Vice President and CEO of Grupo Financiero Scotiabank Mexico and Scotiabank International. She is currently CEO of BNP PARIBAS Cardif, Mexico. She specializes in finance and banking in general.

Regulation and Legislation

The financial sector is one of the most regulated industries in the country, for its performance must project an image of confidence before the market; we accomplish this in accordance with the principles and values that govern our actions.

Regulatory compliance in all aspects of our institution is a priority, as this guarantees proper operation and provision of our services, according to the legal framework of our country and, if not met, could result in fines and costs for our Group.

In Mexico we submit to provisions of various regulators, including Comisión Nacional Bancaria y de Valores (CNBV), the Banco de Mexico (BANXICO), the Comisión Nacional para la Defensa de los Usuarios de las Instituciones Financieras (CONDUSEF), and the Secretaría de Hacienda y Crédito Público (SHCP). Moreover, in Peru, we adhere to the guidelines of the Superintendencia de Banca y Seguros (SBS), the Superintendencia de Mercado de Valores (SMD) and the Banco Central de Reservas (BCR). Finally, in Guatemala, since we are constituted as a corporation, we apply the industry and commerce regulations in this country.

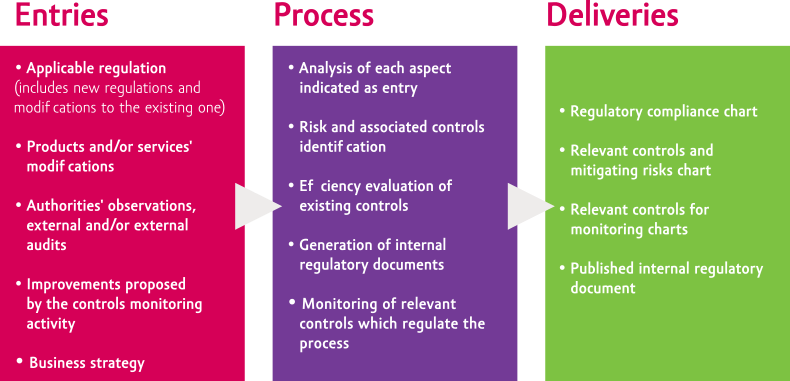

To support our corporate governance to comply the current regulatory compliance, in Gentera we have the Internal Control and Compliance Direction. The activities performed by this Direction are executed with the participation of the areas responsible for the different procedures of the institution, whose stages are:

With this procedure we seek that in the moment we detect any irregularities, we immediately mitigate impacts and respond requests, in addition to executing efficient and effective operations, having reliable and timely financial information, comply fully with applicable laws and regulations and achieve safeguarding the institution resources.

This direction’s objectives for 2015 are:

- Analyze and review controls per area/process, considering their cost, saving and risk

- Contribute to regulatory compliance and banking authorities’ requirements

- Implement and maintain the applicable control framework for information technologies

- Establish measures and procedures to prevent and detect operations vulnerable to money laundering and/or terrorism financing

- Comply with the Federal Law on the Protection of Personal Data held by Private Parties and its regulations

| Probability of occurrence next year | |

|---|---|

| High | The risk is very likely to materialize in 2015 |

| Average | The risk is not likely to materialize in 2015 |

| Low | Very probably, the risk will not materialize in 2015 |

Risk Management

At Gentera we have a specialized area for structuring a strong process of strategic business and process risk management. This area ensures that all proceedings are conducted efficiently in all the subsidiaries: governance, risk and compliance.

The area has a risk map –support tool for Risk Committee–, the Risk Management Manual (MPRI-01), the framework for comprehensive risk management (EST-04) and the annual strategy of comprehensive risk management, aligned with the strategies approved by the Board of Directors. Similarly, it uses a specific methodology for proper and timely response to identified risks, this is the one established by the Comprehensive Risk Management Unit (UAIR), same which has a categorization of the probability of occurrence, and another for impacts caused if the risk materializes, both as signals.

| Impact in case the risk materializes | |

|---|---|

| High | Over 5% of expected annual net income |

| Average | Between 1% and 5% of expected annual net income |

| Low | Under 1% of expected annual net income |

Currently, derived from the restructuring our Group was subject to during 2014, it is through this department that we also perform the explicit risks mapping in regards of sustainability, through proper identification and social and environmental risk evaluation to determine the specific tasks and lines of action that will be executed by each operational area.

Furthermore, the situation and degree of participation of the risk management area were identified in the value chain, in social, environmental and human issues.

The challenges we face in 2014 were diverse, among them the issue of liquidity, since we are susceptible to macroeconomic, market and internal crisis; natural disasters, such as the case of Hurricane Odile, same that caused risk in the portfolio and that the recovery time was extensive.

In this regard, we have identified climate change as a risk agent for our Group, in physical and economic terms, translated as the increased likelihood of natural disasters threatening infrastructure in our branches, causes an increase in operating expenses and an impact on credit origination and recovery. According to the UAIR signals exposed, the likelihood of the risk materializing is low, while the impact is average in case of external events in the season between June 1st and November 30, 2015 according to the National Weather System.

In 2014, the implemented measures were the business continuity plan, change of databases in branches and the allocation of an amount over five million pesos to manage these risks. Additionally, by having a strengthened process for risk management, we have established a strong and adaptable contingency plan to meet future contingencies.

Similarly, we have established support in contingencies, with it we refer to severe damage that could affect the population of one or more states by the impact of a devastating disaster, whether natural or anthropogenic origin, facing the loss of its members, infrastructure or environment. This support process is aimed at providing economic or in kind incentives to employees, clients and the community to help meet the needs that arise during an unexpected situation and affect business continuity. Specific actions executed by the corresponding area are:

- Damage evaluation

- Guarantee critical function continuity in operations

- Timely attention in vulnerable regions

Our main challenges for 2015 are to continue the strengthening of our risk management and provide stability to the results of our restructuring; comprehensive risk management of new businesses, like the use of new technologies, respectively; consolidating products; mitigation of high impact risks that prevent the achievement of our strategic objectives; respond to regulatory modifications regarding liquidity and capitalization; among others, but certainly we will be able to respond successfully with support from our expert team in risk management.

Industry involvement

DMA 37, 47, 49

At Gentera we aim, through links with authorities and organisms, to influence those actors with power of decision in certain issues of interest for the financial sector and, this way, we seek to establish the guidelines and activities to be followed for approaching authorities, regulators, legislators, federal and local government, in order to generate a favorable environment for Gentera and its companies’ development.

Such is the case of Compartamos Banco, who collaborates actively in several industry institutions and associations, such as the Asociación de Bancos de México (ABM), in which Compartamos participates in commissions and/or committees. In them, the Bank’s representative has a voice on behalf of the institution to address relevant issues in each assembly, whose availability of guides and registry for vote casting is internal to the ABM.

Some resolutions issued by the ABM Sustainability Committee are:

- Sustainability protocol’s presentation to the ABM loan committees –Mortgage, SME, Agriculture, Business, Credit Risk, Government Banking and Infrastructure Development, and the establishment of working groups

- Participation of 25 banking institutions (90% of total) in the Carbon Footprint project

- Besides Compartamos Banco’s participation in the ABM, we are members in several others associations, such as:

Mexico

- Asociación Mexicana de Comunicadores, A.C. (AMCO)

- Asociación Mexicana de Directores de Recursos Humanos, AC. (AMERIH)

- Confederación Patronal de la República Mexicana, S.P. (COPARMEX)

- Consejo de la Comunicación, A.C.

- Microfinance Information Exchange Mix Market

- Micro Finance Network

- Gender Equality Project (EDGE)

- ProDesarrollo Finanzas y Microempresa, A.C.

- Red ACCION

- Unión de Instituciones Financieras Mexicanas (UNIFIM)

- Unión Social de Empresarios de México, A.C. (USEM)

- Foro Económico Mundial (World Economic Forum)

- Microinsurance Network

Peru

- Asociación de Instituciones de Microfinanzas del Perú (ASOMIF)

- Asociación de Bancos del Perú (ASBANC)

In Guatemala we are currently researching the associations which we will be members of in the short term.