Financial education

g4-14

DMA 43, 47

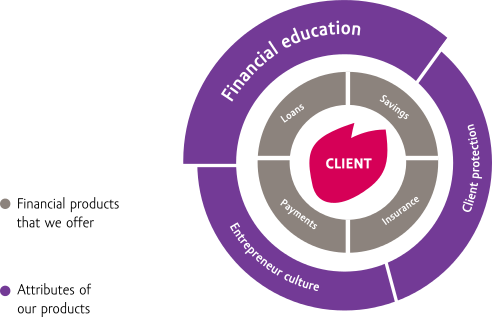

Financial education is one of the key elements for our actions and through which we seek to create human value for our clients. Our business model is based on personal and constant contact with our clients, therefore we are able to encourage a savings and caution culture through the use of our services; thus generating conscience to avoid indebtedness.

dma 3, 35 / sp 3

Since 2005, the Organization for Economic Cooperation and Development (OECD) has invited several public and private institutions to carry out financial education actions, and has stressed the importance of citizens having information for financial decision making. In 2013, the World Bank conducted a study about financial capabilities, where Mexico has a significant challenge so the population manages its finances better.

For this reason, Gentera is part of the banking institutions who works for financial education, through Compartamos Banco since 2009. Currently, Compartamos Financiera and Compartamos S.A. also have each financial education programs.

Providing financial education to people in the bottom of the pyramid who use financial services has a positive impact on the communities where we operate, since they have further information about the products they purchase. Its importance lies in the pursuit of financial capabilities’ development through training and informative strategies among employees, clients and the community; which contribute to accurate decisions in resources’ management and use of financial services responsibly, motivating theirs and their families’ wellbeing.

To guarantee the development of financial education actions within our financial products, we established a process to identify and define the contents for the programs that will be imparted to the Group’s clients; such process consists of:

-

1.Conduct a diagnosis study to identify our clients’ financial education needs

-

2.According to the study’s results, the content to insert it in the credit methodology is designed

-

3.Carry out an experimental test to identify adjustments in the content

-

4.Once the content is adjusted, training is implemented and made accessible

Our goal is to create financial capabilities within the family core, this way facilitating the application of healthy finances in daily life, that benefit people’s life quality and planning of a secure future.

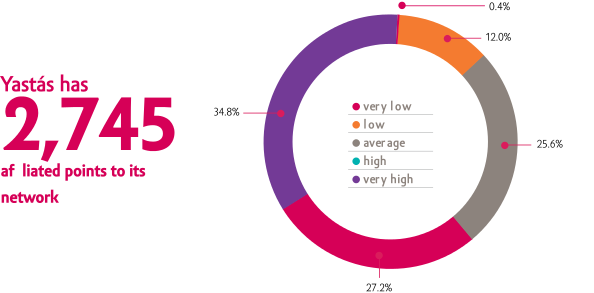

The training strategy includes the development of skills, conduct and competencies modifications, and fresh knowledge starting from several training actions. It is comprised by actions such as financial education workshops and courses for clients and employees focused on topics like expenses management, budgets, saving tools, credit management, insurances, investments and responsible consumption. Examples of these are the “Improving my personal finances” workshop –part of the Crédito Mujer methodology in Mexico, Peru and Guatemala– which entails imparting workshops of six sessions lasting 15 minutes each; and the “Manage your money” workshop, along with Yastás in Mexico. Additionally, along with Fundación NEMI, we carry out actions with the community that involve a conference cycle in public middle schools and theater plays in public elementary schools to strengthen a financial education and environmental protection culture.

Training actions by target audience:

-

Employees

-

Induction for Crédito Mujer in Mexico, Peru and Guatemala

-

Personal finances training for regional instructors

-

Clients

-

“Improving my personal finances” workshop for Crédtio Mujer clients in Mexico, Peru and Guatemala

-

Community

-

“Sharing adventures” play in elementary schools

-

“Your life, your project” conference in middle schools

100% of Crédito Mujer promoters trained to impart the “improving my personal finances” workshop in Mexico, Peru and Guatemala

The informative strategy aims to provide useful and convenient information for financial decision making. We disseminate topics like budgets, savings, responsible consumptions, insurances, investments and advice on how to avoid indebtedness through printed magazines –Compartamos Consejos– for clients and –Compartips– for employees, besides electronic content in the intranet and social media.

Impacts by publication:

-

625,315 impacted employees

-

1’594,634 clients

-

387,249 community

As part of the Crédito Mujer methodology, the financial education team monitored the branches which impart this workshop to supervise its implementation. In 2014, 98% of Mexico’s branches were supervised and the workshop was integrated to 46% of Peru’s branches and 100% of them in Guatemala. Also, to discover the workshop’s reach and effectivity, quarterly surveys were conducted through a call center, where clients shared their opinions regarding the “Improving my personal finances” workshop.

fs7

From our perspective, financial education is an inherent service in our products, same that we have designed to provide a specific social benefit, and which we apply in several business lines, achieving the inclusion of a greater number of clients in this dynamic.

|

Monetary value of financial education by business line

|

|

Products

|

Outlay

|

|

Crédito Mujer

|

$1’015,297.5

|

|

Crédito Comerciante

|

$103,250.0

|

|

Crédito Individual

|

$41,007.5

|

|

Training

|

$18,807.0

|

|

Insurance

|

$9,900.0

|